All Categories

Featured

Table of Contents

After buying a tax obligation lien, you should notify the house owners. While similar, tax obligation liens and tax obligation deeds have a different sale auction process.

When a person bids and wins at a tax obligation act public auction, the tax deed is transferred to the winning prospective buyer, and they obtain possession and rate of interest of the property. If the state has a redemption duration, the property proprietor can pay the delinquent taxes on the residential or commercial property and redeem their possession.

Tax obligation lien sales occur within 36 states, and 31 states allow tax act sales (some permit both). The certain purchasing procedure of these sales differ by region, so be sure to investigate the policies of the location you are aiming to buy in prior to getting started. Tax obligation lien investing offers a special possibility for possibly high returns and residential or commercial property procurement.

Tax lien investing can offer your profile direct exposure to property all without needing to actually possess property. Specialists, however, claim the procedure is complicated and warn that amateur capitalists can conveniently get shed. Right here's whatever you need to recognize about purchasing a tax obligation lien certificate, including exactly how it functions and the threats entailed.

The notification usually comes prior to harsher actions, such as a tax levy, where the Irs (IRS) or regional or community federal governments can actually confiscate a person's property to recuperate the financial obligation. A tax lien certification is created when a property owner has fallen short to pay their tax obligations and the neighborhood government problems a tax lien.

Tax Liens And Deeds Investing

Tax lien certifications are generally auctioned off to investors wanting to earnings. To recuperate the overdue tax dollars, towns can then sell the tax lien certification to personal investors, who deal with the tax obligation costs for the right to accumulate that money, plus interest, from the building owners when they at some point pay back their equilibrium.

permit the transfer or project of overdue real estate tax obligation liens to the economic sector, according to the National Tax Obligation Lien Association, a nonprofit that stands for governments, institutional tax obligation lien capitalists and servicers. Here's what the procedure looks like. Tax obligation lien investors have to bid for the certification in an auction, and just how that procedure works depends upon the details municipality.

Get in touch with tax obligation officials in your area to inquire exactly how those delinquent taxes are accumulated. Auctions can be on-line or in individual. In some cases winning proposals go to the financier ready to pay the least expensive rates of interest, in a technique known as "bidding down the passion rate." The municipality develops an optimum price, and the prospective buyer using the lowest interest price below that optimum wins the auction.

Other winning proposals go to those who pay the highest possible money amount, or premium, over the lien amount. The winning bidder has to pay the entire tax costs, consisting of the delinquent financial obligation, rate of interest and penalties.

While some financiers can be rewarded, others might be captured in the crossfire of complicated regulations and technicalities, which in the most awful of situations can lead to large losses. From a simple revenue standpoint, the majority of capitalists make their money based on the tax lien's rate of interest. Rate of interest vary and depend upon the jurisdiction or the state.

Earnings, nonetheless, do not always total up to returns that high throughout the bidding procedure. In the end, the majority of tax obligation liens acquired at public auction are offered at prices between 3 percent and 7 percent across the country, according to Brad Westover, executive supervisor of the National Tax Lien Organization. Before retiring, Richard Rampell, formerly the primary executive of Rampell & Rampell, an accountancy firm in Palm Beach, Florida, experienced this direct.

Investing In Tax Liens Risks

Initially, the companions did well. Yet then huge institutional investors, including financial institutions, hedge funds and pension funds, chased after those greater yields in auctions around the nation. The bigger capitalists helped bid down rate of interest prices, so Rampell's group wasn't making significant money anymore on liens. "At the end, we weren't doing much better than a CD," he claims.

However that seldom occurs: The taxes are generally paid prior to the redemption date. Liens also are first eligible settlement, even before home mortgages. However, tax liens have an expiration day, and a lienholder's right to seize on the building or to accumulate their financial investment expires at the exact same time as the lien.

Best Tax Lien States For Investing

"In some cases it's six months after the redemption duration," Musa says - how to invest in property tax liens. "Do not assume you can just buy and forget about it." Private investors that are taking into consideration investments in tax obligation liens should, above all, do their homework. Experts suggest avoiding residential properties with environmental damage, such as one where a gas station unloaded dangerous product.

"You should truly comprehend what you're getting," states Richard Zimmerman, a partner at Berdon LLP, an accountancy company in New York City. "Recognize what the building is, the neighborhood and values, so you do not buy a lien that you will not be able to gather (tax lien investing books)." Potential financiers should also examine out the property and all liens versus it, as well as current tax obligation sales and list price of comparable properties

"People obtain a list of properties and do their due persistance weeks prior to a sale," Musa says. "Fifty percent the properties on the list may be gone because the tax obligations obtain paid.

Westover says 80 percent of tax lien certifications are offered to members of the NTLA, and the firm can often pair up NTLA members with the ideal institutional capitalists. That may make handling the process simpler, particularly for a novice. While tax obligation lien investments can provide a generous return, recognize the fine print, details and policies.

"However it's made complex. You have to recognize the information." Bankrate's added to an update of this story.

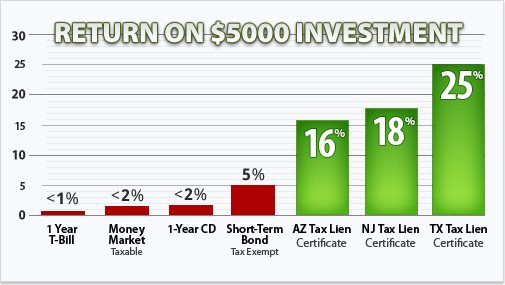

Tax liens are an effective method to do this. In Arizona, an individual may acquire tax obligation liens and acquire up to 16% on their financial investment if they are redeemed.

Bob Diamond

The. As such, the investors bid on tax liens at a reverse auction, indicating that at 16% there might be 10 people curious about this tax obligation lien, yet at 10% there may be 3 people, and you may be the winning proposal if you're still curious about the tax lien at 5%.

If the tax lien is not retrieved, you have a right to bid on succeeding tax obligation liens. If you hold the tax lien between 3 and 10 years, you might start the procedure of confiscating upon the tax lien. To foreclose upon a tax lien in Arizona, the certificate of purchase holder should initially send a licensed letter thirty days prior to filing a suit to give notice to the lienholder that pleases the appropriate law.

The genuine residential property tax obligation parcel identification number. The lawful description of the real estate. The certificate of acquisition number. The proposed day of submitting the action. The property holder will redeem the tax obligations before you have to confiscate. When the lien owner redeems, the holder of the certification of acquisition gets its principal plus its rate of interest.

If you want the tax obligation lien repossession process, you ought to contact a lawyer so you comprehend and consider the risks of this type of investment.

Profit By Investing In Tax Liens

The yearly public auction of actual estate tax obligation liens will be held as a net auction. Bidding will certainly begin on November 4, 2024, at 8:00 a.m. local time and will close on November 6, 2024, at 5:00 p.m.Delinquent Real Estate Tax payments must be received in our office by 3:30 p.m. local time Friday, November 1, 2024.

Latest Posts

Tax Lien Investing Course

Tax Liens Investing Reddit

Real Estate Tax Lien Investments For Tax-advantaged Returns