All Categories

Featured

Table of Contents

- – What Are The Benefits Of Learning Investor Onl...

- – What Are The Most Effective Courses On Asset R...

- – What Is The Most In-Demand Course For Investo...

- – Which Course Is The Top Choice For Investors ...

- – What Are The Highest Rated Courses For Real ...

- – How Does Bob Diamond Define Success In Train...

Any type of continuing to be excess comes from the owner of record right away prior to the end of the redemption duration to be asserted or designated according to law - investor network. These amounts are payable ninety days after implementation of the act unless a judicial activity is instituted during that time by one more plaintiff. If neither asserted neither assigned within 5 years of date of public auction tax sale, the overage shall escheat to the general fund of the regulating body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, guided the Code Commissioner to change all recommendations to "Register of Mesne Conveyances" to "Register of Deeds" any place appearing in the 1976 Code of Rules. AREA 12-51-135. Removal of erroneously released warrants. If a warrant, which has actually been filed with the clerk of court in any type of region, is identified by the Department of Revenue to have been issued and submitted at fault, the staff of court, upon notification by the Division of Profits, should remove the warrant from its book.

What Are The Benefits Of Learning Investor Online?

201, Part II, Area 49; 1993 Act No. 181, Area 231. AREA 12-51-140. Notification to mortgagees. The provisions of Sections 12-49-1110 through 12-49-1290, inclusive, connecting to notice to mortgagees of suggested tax sales and of tax sales of residential or commercial properties covered by their respective home mortgages are adopted as a part of this chapter.

Code Commissioner's Note At the instructions of the Code Commissioner, "Areas 12-49-1110 through 12-49-1290" was alternatived to "Sections 12-49-210 with 12-49-300" due to the fact that the last areas were reversed. SECTION 12-51-150. Authorities may void tax sales. If the official accountable of the tax obligation sale uncovers before a tax title has actually passed that there is a failure of any action required to be properly done, the official might void the tax obligation sale and reimbursement the quantity paid, plus interest in the quantity in fact made by the region on the quantity reimbursed, to the effective prospective buyer.

HISTORY: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Area 14; 2006 Act No. 386, Sections 35, 49. D, eff June 14, 2006. Code Commissioner's Note At the instructions of the Code Commissioner, the very first sentence as modified by Section 49. D of the 2006 change is set forth above.

Contract with county for collection of tax obligations due community. A county and community might get for the collection of community taxes by the county.

What Are The Most Effective Courses On Asset Recovery?

He may use, select, or assign others to perform or accomplish the provisions of the chapter. BACKGROUND: 1962 Code Section 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Section 16.

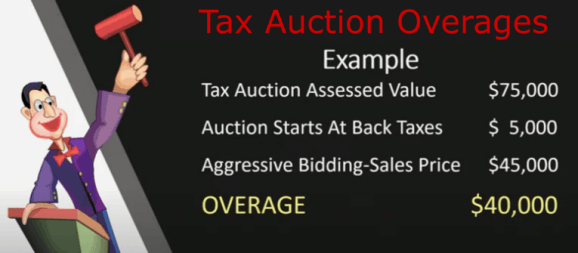

Tax liens and tax actions commonly cost higher than the area's asking rate at auctions. In addition, a lot of states have regulations influencing bids that surpass the opening bid. Payments above the region's criteria are called tax sale excess and can be successful financial investments. The details on overages can create troubles if you aren't aware of them.

In this short article we inform you how to get lists of tax obligation excess and make cash on these assets. Tax sale overages, likewise called excess funds or superior bids, are the quantities bid over the beginning price at a tax public auction. The term describes the dollars the investor spends when bidding process above the opening proposal.

What Is The Most In-Demand Course For Investor Resources Training?

The $40,000 increase over the original proposal is the tax obligation sale excess. Claiming tax sale excess indicates obtaining the excess cash paid throughout an auction.

That claimed, tax sale overage claims have actually shared qualities throughout the majority of states. Usually, the county holds the cash for a specified period relying on the state. During this period, previous proprietors and mortgage holders can speak to the area and obtain the excess. Nevertheless, areas typically don't locate past proprietors for this purpose.

Which Course Is The Top Choice For Investors In Training Resources?

If the period expires before any interested celebrations claim the tax sale overage, the area or state generally absorbs the funds. Past owners are on a strict timeline to insurance claim overages on their buildings.

, you'll gain rate of interest on your whole bid. While this aspect doesn't suggest you can declare the overage, it does assist minimize your costs when you bid high.

Bear in mind, it may not be legal in your state, meaning you're limited to gathering interest on the overage - financial resources. As mentioned over, a financier can locate ways to benefit from tax sale overages. Since interest income can put on your whole proposal and past owners can claim overages, you can utilize your knowledge and devices in these scenarios to take full advantage of returns

A critical facet to keep in mind with tax sale overages is that in most states, you just need to pay the area 20% of your overall bid in advance. Some states, such as Maryland, have regulations that exceed this guideline, so again, study your state legislations. That stated, most states comply with the 20% guideline.

What Are The Highest Rated Courses For Real Estate Training Training?

Instead, you only need 20% of the proposal. Nevertheless, if the building does not redeem at the end of the redemption period, you'll require the continuing to be 80% to acquire the tax obligation act. Since you pay 20% of your proposal, you can earn interest on an excess without paying the complete rate.

Once again, if it's legal in your state and region, you can deal with them to aid them recover overage funds for an additional charge. So, you can collect interest on an overage bid and charge a cost to improve the overage claim procedure for the past proprietor. Tax obligation Sale Resources just recently released a tax obligation sale excess product especially for people thinking about pursuing the overage collection service.

Overage collection agencies can filter by state, county, home kind, minimum overage amount, and maximum overage quantity. When the information has been filtered the collectors can make a decision if they wish to include the miss mapped information package to their leads, and after that pay for only the confirmed leads that were discovered.

How Does Bob Diamond Define Success In Training Resources?

In addition, simply like any kind of other financial investment strategy, it offers distinct pros and disadvantages. investor network.

Table of Contents

- – What Are The Benefits Of Learning Investor Onl...

- – What Are The Most Effective Courses On Asset R...

- – What Is The Most In-Demand Course For Investo...

- – Which Course Is The Top Choice For Investors ...

- – What Are The Highest Rated Courses For Real ...

- – How Does Bob Diamond Define Success In Train...

Latest Posts

Tax Lien Investing Course

Tax Liens Investing Reddit

Real Estate Tax Lien Investments For Tax-advantaged Returns

More

Latest Posts

Tax Lien Investing Course

Tax Liens Investing Reddit

Real Estate Tax Lien Investments For Tax-advantaged Returns